Universal Music Group N.V. Reports Financial Results for the First Quarter Ended March 31, 2024

Q1 2024 Results Highlights1

-Revenue of €2,594 million increased 5.8% year-over-year, or 7.9% in constant currency, driven by solid growth in all segments.

-Recorded Music subscription revenue grew 10.7% year-over-year, or 12.5% in constant currency, and streaming revenue grew 8.9% year-over-year, or 10.3% in constant currency.

-Music Publishing revenue grew 16.7% year-over-year, or 18.4% in constant currency.

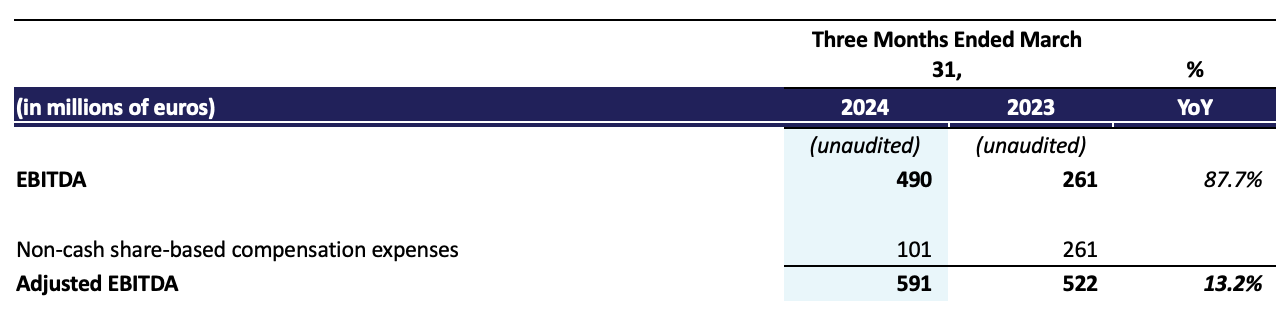

-Adjusted EBITDA of €591 million increased 13.2% year-over-year, or 15.9% in constant currency, and Adjusted EBITDA margin expanded 1.5 percentage points to 22.8%.

-Top sellers included Taylor Swift, Noah Kahan, Morgan Wallen, Ariana Grande and Olivia Rodrigo.

1. This press release includes certain alternative performance indicators which are not defined in the International Financial Reporting Standards (“IFRS”) issued by the International Accounting Standards Board as endorsed by the EU. The descriptions of these alternative performance indicators and reconciliations of non-IFRS to IFRS measures are included in the Appendix to this press release.

Hilversum, The Netherlands, May 2, 2024 — Universal Music Group N.V. (“UMG” or “the Company”) today announced its financial results for the first quarter ended March 31, 2024.

“UMG’s continuing success is in large measure attributable to the fact that we always put artists at the center of everything we do and surround them with the industry’s most experienced teams and our broad-based and strategically integrated portfolio of businesses.” said UMG’s Chairman and CEO Sir Lucian Grainge. “Our strategic plan is once again driving a strong start to the year, reflected in our results, as well as the exceptional performance of our artists around the world.”

Boyd Muir, UMG’s EVP, CFO and President of Operations said, “2024 is off to a healthy start, with revenue growth in all segments as well as strong Adjusted EBITDA growth and margin expansion. We remain encouraged by the trajectory of the business and with the execution of our plans for this year and the years ahead.”

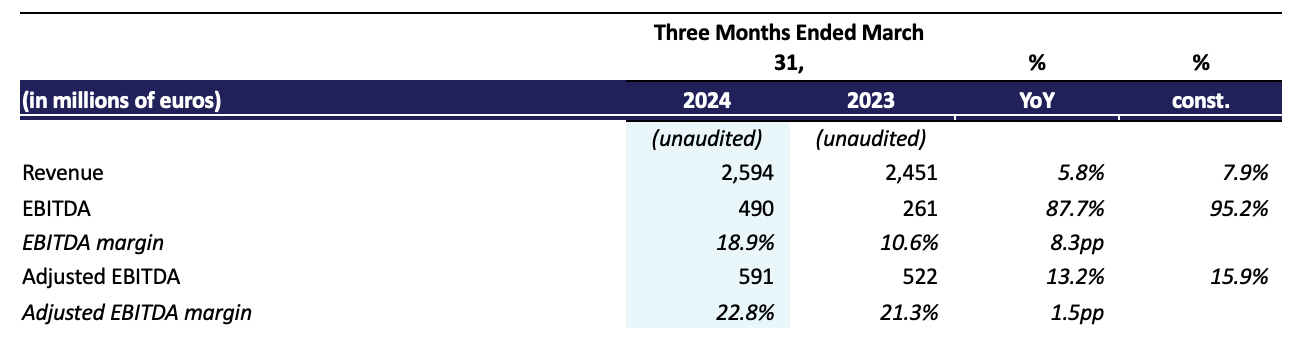

UMG Results

Note: % YoY indicates % change year-over-year; % const. indicates % change year-over-year adjusted for constant currency. Constant currency is calculated by taking current year results and comparing against prior year results restated at current year rates.

Q1 2024 Results

Revenue for the first quarter of 2024 was €2,594 million, an increase of 5.8% year-over-year, or 7.9% in constant currency, driven by healthy growth in all segments, as discussed further below.

EBITDA for the quarter grew 87.7% year-over-year, or 95.2% in constant currency, to €490 million and EBITDA margin was 18.9%, compared to 10.6% in the first quarter of 2023. This increase reflects lower non-cash share-based compensation expenses of €101 million during the first quarter of 2024, compared to €261 million of non-cash share-based compensation expenses during the first quarter of 2023. Excluding non-cash share-based compensation expenses, Adjusted EBITDA for the quarter was €591 million, up 13.2% year-over-year, or 15.9% in constant currency, and Adjusted EBITDA margin expanded 1.5 percentage points to 22.8%, compared to 21.3% in the first quarter of 2023, as a result of revenue growth, operating leverage and incremental cash compensation savings of €12 million associated with the equity plan rollout compared to the first quarter of 2023.

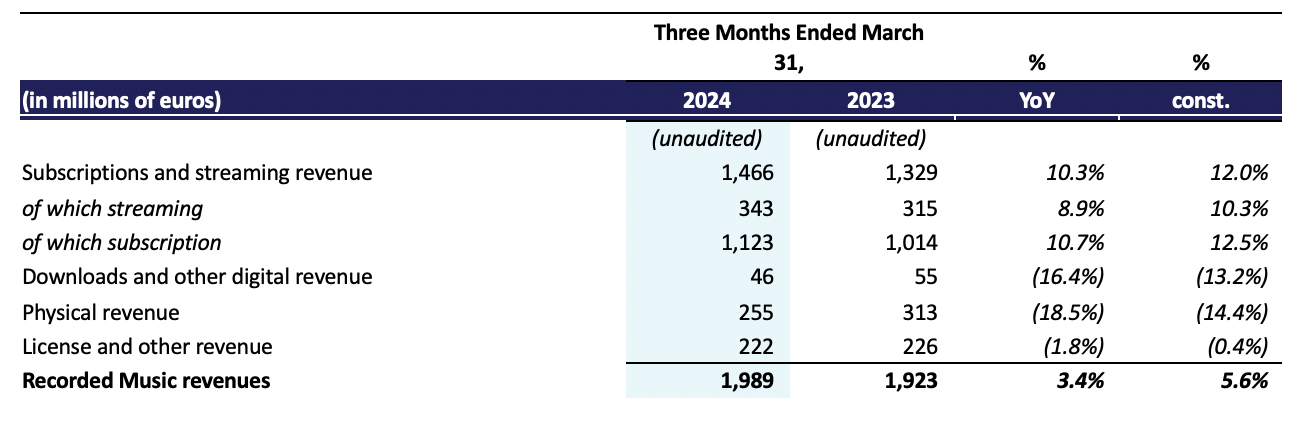

Recorded Music

Note: % YoY indicates % change year-over-year; % const. indicates % change year-over-year adjusted for constant currency.

Q1 2024

Recorded Music revenue for the first quarter of 2024 was €1,989 million, up 3.4% compared to the first quarter of 2023, or 5.6% in constant currency. Subscription revenue grew 10.7% year-over-year, or 12.5% in constant currency, driven by the growth in global subscribers as well as the continued benefit of price increases at certain platforms. Streaming revenue grew 8.9% year-over-year, or 10.3% in constant currency, as the advertising industry continued to recover. Physical revenue decreased by 18.5% year-over-year, or 14.4% in constant currency, largely due to a very difficult year-over-year comparison, particularly in Japan. Downloads and other digital revenue declined 16.4% year-over-year, or 13.2% in constant currency, as download sales continued their industry-wide decline. License and other revenue declined 1.8% year-over-year, or 0.4% in constant currency, due to a timing-related decline in synchronization revenue. Top sellers for the quarter included releases from Taylor Swift, Noah Kahan, Morgan Wallen, Ariana Grande and Olivia Rodrigo, while top sellers in the prior-year quarter included releases from King & Prince, Morgan Wallen, Taylor Swift, TOMORROW X TOGETHER and back number.

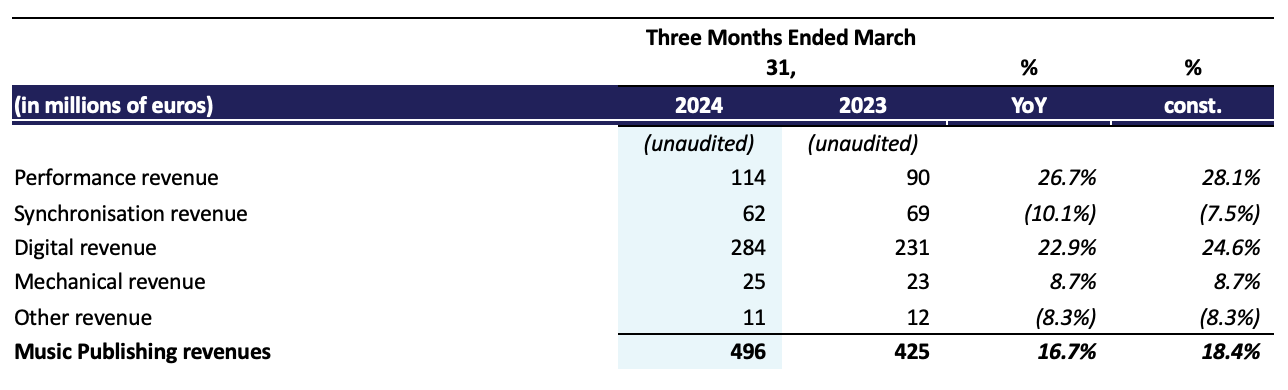

Music Publishing

Note: % YoY indicates % change year-over-year; % const. indicates % change year-over-year adjusted for constant currency.

Q1 2024

Music Publishing revenue for the first quarter of 2024 was €496 million, up 16.7% year-over-year, or 18.4% in constant currency. Digital revenue grew 22.9% year-over-year, or 24.6% in constant currency, driven by continued growth in streaming and subscription revenue. Performance revenue increased 26.7% year-over-year, or 28.1% in constant currency, due in part to higher society payments in the US, as well as greater than anticipated live activity in Europe. Synchronization revenue declined 10.1% year-over-year, or 7.5% in constant currency, as a result of timing. Mechanical revenue grew by 8.7% in both reported and constant currency.

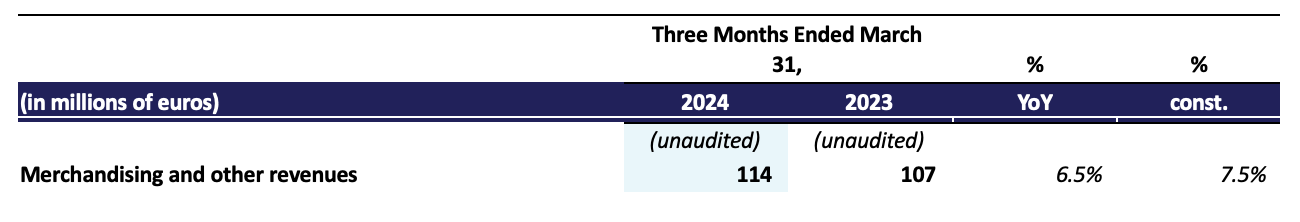

Merchandising and Other

Note: % YoY indicates % change year-over-year; % const. indicates % change year-over-year adjusted for constant currency.

Q1 2024

Merchandising and Other revenue in the first quarter of 2024 was €114 million, an increase of 6.5% year-over-year, or 7.5% in constant currency, driven by increased touring merchandise sales, partly offset by a decrease in direct-to-consumer and retail sales due to a difficult comparison.

Conference Call Details

The Company will host a conference call to discuss these results on Thursday, May 2, 2024 at 6:15PM CEST. A link to the live audio webcast will be available on investors.universalmusic.com and a link to the replay will be available after the call.

While listeners may use the webcast, a dial-in telephone number is required for investors and analysts to ask questions. Investors and analysts interested in asking questions can pre-register for a dial-in line at investors.universalmusic.com under the “Financial Reports” tab.

Cautionary Notice

This press release is published by Universal Music Group N.V. and contains inside information within the meaning of article 7(1) of Regulation (EU) No 596/2014 (Market Abuse Regulation).

Forward-looking statements

This press release may contain statements that constitute forward-looking statements with respect to UMG’s financial condition, results of operations, business, strategy and plans. Such forward-looking statements may be identified by the use of words such as ‘profit forecast’, ‘expect’, ‘estimate’, ‘project’, ‘anticipate’, ‘should’, ‘intend’, ‘plan’, ‘probability’, ‘risk’, ‘target’, ‘goal’, ‘objective’, ‘will’, ‘endeavour’, ‘optimistic’, ‘prospects’ and similar expressions or variations on such expressions. Although UMG believes that such forward-looking statements are based on reasonable assumptions, they are not guarantees of future performance. Actual results may differ materially from such forward-looking statements as a result of a number of risks and uncertainties, many of which are related to factors that are outside UMG’s control, including, but not limited to, UMG’s inability to compete successfully and to identify, attract, sign and retain successful recording artists and songwriters, failure of streaming and subscription adoption or revenue to grow or to grow less rapidly than anticipated, UMG’s reliance on digital service providers, UMG’s inability to execute its business strategy, the global nature of UMG’s operations, UMG’s inability to protect its intellectual property and against piracy, UMG’s inability to attract and retain key personnel, changes in laws and regulations and the other risks that are described in UMG’s 2023 Annual Report. Accordingly, UMG cautions readers against placing undue reliance on such forward-looking statements. Such forward-looking statements are made as of the date of this press release. UMG disclaims any intention or obligation to provide, update or revise any such forward-looking statements, whether as a result of new information, future events or otherwise.

Alternative Performance Indicators

This press release includes certain alternative performance indicators which are not defined in IFRS issued by the International Accounting Standards Board as endorsed by the EU. The descriptions of these alternative performance indicators and reconciliations of non-IFRS to IFRS measures are included in the Appendix to this press release.

About Universal Music Group

At Universal Music Group (EURONEXT: UMG), we exist to shape culture through the power of artistry. UMG is the world leader in music-based entertainment, with a broad array of businesses engaged in recorded music, music publishing, merchandising and audiovisual content. Featuring the most comprehensive catalogue of recordings and songs across every musical genre, UMG identifies and develops artists and produces and distributes the most critically acclaimed and commercially successful music in the world. Committed to artistry, innovation and entrepreneurship, UMG fosters the development of services, platforms and business models in order to broaden artistic and commercial opportunities for our artists and create new experiences for fans. For more information on Universal Music Group N.V. visit www.universalmusic.com.

Contacts

Media

James Murtagh-Hopkins – communicationsnl@umusic.com

Investors

Erika Begun – investorrelations@umusic.com

Upcoming Calendar

Annual General Meeting of Shareholders: May 16, 2024

Appendix

Non-IFRS Alternative Performance Indicators and Reconciliations

Reconciliation of Adjusted EBITDA

Definitions

In this press release, UMG presents certain financial measures when discussing UMG’s performance that are not measures of financial performance or liquidity under IFRS (“non-IFRS”). These non-IFRS measures (also known as alternative performance indicators) are presented because management considers them important supplemental measures of UMG’s performance and believes that they are widely used in the industry in which UMG operates as a means of evaluating a company’s operating performance and liquidity. UMG believes that an understanding of its sales performance, profitability, financial strength and funding requirements is enhanced by reporting the following non-IFRS measures. All non-IFRS measures should be considered in addition to, and not as a substitute for, other IFRS measures of operating and financial performance as described in this press release. In addition, it should be noted that other companies may have definitions and calculations for these non-IFRS measures that differ from those used by UMG, thereby affecting comparability.

EBITDA and EBITDA margin

UMG considers EBITDA and EBITDA margin, non-IFRS measures, to be relevant measures to assess its operating performance and the performance of its operating segments as reported in the segment data. It enables UMG to compare the performance of operating segments regardless of whether their performance is driven by the operating segment’s organic growth or by acquisitions. It excludes restructuring expenses, which may impact period-to-period comparability. EBITDA margin is EBITDA divided by revenue. To calculate EBITDA, the accounting impact of the following items is excluded from the Operating Profit:

i) amortization of intangible assets;

ii) impairment on goodwill and other intangibles;

iii) depreciation of tangible assets including right of use assets;

iv) (gains)/losses on the sale of tangible assets, including right of use assets and intangible assets; and

v) restructuring expenses.

Adjusted EBITDA and Adjusted EBITDA margin

The difference between EBITDA and Adjusted EBITDA consists of non-cash share-based compensation expenses and certain one-time items that are deemed by management to be significant and incidental to normal business activity. Adjusted EBITDA margin is Adjusted EBITDA divided by revenue. UMG considers Adjusted EBITDA and Adjusted EBITDA margin, non-IFRS measures, to be relevant measures to assess performance of its operating activities excluding items that may be incidental to normal business activity and excluding non-cash share based compensation which may impact period-to-period comparability.