Universal Music Group N.V. Reports Financial Results for the First Quarter Ended March 31, 2022

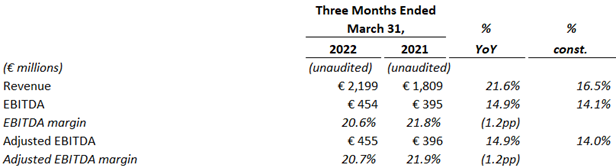

Summary Q1 Results[1]

Revenue of €2,199 million, representing growth of 16.5% year-over-year in constant currency, driven by strong growth across all segments

Recorded Music revenue grew 11.3% year-over-year in constant currency, Music Publishing revenue grew 32.5% year-over-year in constant currency and Merchandising and Other revenue grew 69.8% year-over-year in constant currency

Adjusted EBITDA increased 14.0% year-over-year in constant currency driven by the revenue growth

Hilversum, The Netherlands, May 3, 2022 — Universal Music Group N.V. (“UMG” or “the Company”) today announced its financial results for the first quarter ended March 31, 2022.

“As important as the positive performance of the business this quarter is its breadth and strength,” said Sir Lucian Grainge, UMG’s Chairman and CEO. “Our strategic portfolio approach–creatively, geographically, technologically, and across a broad range of artists, partners, formats, businesses and revenue streams–not only deliver results now but, over the long run, we believe will produce an even better and more stable performance while delivering incredible value to our artists and shareholders.”

“With this quarter’s results, we continue to deliver on our commitment of long-term growth throughout the company’s major business units and across its multiple and growing revenue streams, including ad-supported streaming, subscription, physical, licensing, music publishing, and merchandising, among others,” said Boyd Muir, EVP, CFO and President of Operations for UMG. “We remain enthusiastic about the diversified revenue growth that our strategy is producing.”

UMG Results

Note: % YoY indicates % change year-over-year; % const. indicates % change year-over-year adjusted for constant currency. Constant currency change is calculated by taking current year results and comparing against prior year results restated at current year rates.

Q1 2022

Revenue for the first quarter of 2022 was €2,199 million, an increase of 21.6% year-over-year, or 16.5% in constant currency. UMG’s Recorded Music, Music Publishing and Merchandising and Other segments all had strong, double-digit revenue growth, as discussed further below.

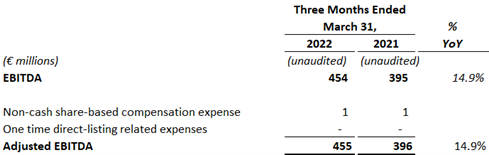

EBITDA for the quarter grew 14.9% year-over-year, or 14.1% in constant currency, to €454 million, driven by revenue growth. EBITDA margin was 20.6%, compared to 21.8% in the first quarter of 2021. EBITDA and EBITDA margin were impacted by €1 million of non-cash share-based compensation during both the first quarter of 2022 and the first quarter of 2021. Excluding these items, Adjusted EBITDA for the quarter was €455 million, up 14.9% year-over-year, or 14.0% in constant currency, driven by revenue growth. Adjusted EBITDA margin was 20.7%, compared to 21.9% in the first quarter of 2021. In the first quarter of 2021, EBITDA, Adjusted EBITDA, EBITDA margin and Adjusted EBITDA margin had a €20 million benefit related to a release of historic royalty provisions and an exceptional recovery of artist related provisions. EBITDA and Adjusted EBITDA margins were also impacted by revenue mix, as revenues were more heavily weighted towards Merchandising and Other revenues in the first quarter of 2022 compared to the prior-year quarter, which carry a significantly lower EBITDA margin than Recorded Music and Music Publishing revenues.

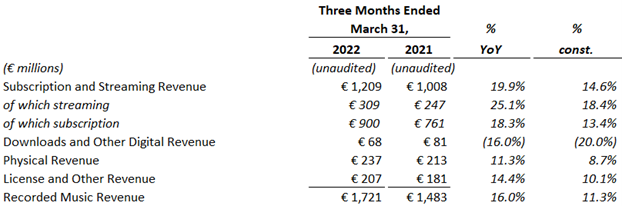

Recorded Music

Note: % YoY indicates % change year-over-year; % const. indicates % change year-over-year adjusted for constant currency.

Q1 2022

Recorded Music revenues for the first quarter of 2022 were €1,721 million, up 16.0% compared to the fourth quarter of 2021, or 11.3% in constant currency. Subscription and streaming revenue grew 19.9% year-over-year, or 14.6% in constant currency, with subscription revenue up 18.3% year-over-year, or 13.4% in constant currency, and ad-supported streaming revenue up 25.1% year-over-year, or 18.4% in constant currency. Physical revenue showed another quarter of strong growth, increasing by 11.3% year-over-year, or 8.7% in constant currency, on improvements in both CD and vinyl sales, led by King & Prince, Fujii Kaze, Ado, Stromae and Taylor Swift. Downloads and other digital revenue were down 16.0% year-over-year, or down 20.0% in constant currency, as download sales continue their industry-wide decline. License and other revenue improved 14.4% year-over-year, or 10.1% in constant currency, as a result of improvements in synchronisation revenue. Top sellers for the quarter included releases from Disney’s ‘Encanto’ Soundtrack, King & Prince, The Weeknd, Fujii Kaze and Ado, while top sellers in the prior-year quarter included King & Prince, Morgan Wallen, The Weeknd, Justin Bieber and Ariana Grande.

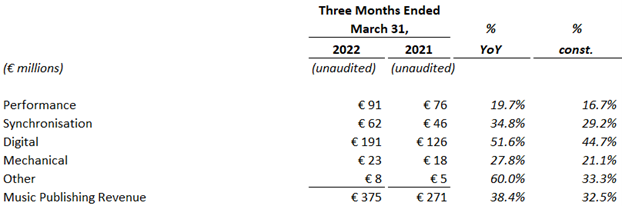

Music Publishing

Note: % YoY indicates % change year-over-year; % const. indicates % change year-over-year adjusted for constant currency.

Q1 2022

Music Publishing revenue amounted to €375 million in the first quarter of 2022, up 38.4% year-over-year, or 32.5% in constant currency.

As disclosed in the UMG Annual Consolidated Financial Statements for 2021, UMG adjusted its accounting policy in relation to certain revenues that are collected through societies. This primarily affected Music Publishing digital, performance, and mechanical revenue. In prior years, these revenues were recognised when the relevant collection society notified UMG of the usage by the end customer and collectability was assured. Recognition of that revenue is now based on an accrual for the best available estimate of when the usage occurs and the amount of consideration which is probable to be collected. This has affected the timing of the recognition of certain revenues across financial reporting quarters, with a benefit for the first quarter of 2022, compared to the prior year.

Music Publishing revenue also benefited from underlying organic growth trends and initial contributions from catalogue acquisitions made in prior years.

Within Music Publishing, digital revenue grew 51.6% year-over-year, or 44.7% in constant currency, reflecting the continued growth of streaming and subscription, as well as the change in accounting. Performance revenue grew 19.7% year-over-year, or 16.7% in constant currency, reflecting the change in accounting. Synchronisation revenue grew 34.8% year-over-year, or 29.2% in constant currency, as a result of increased income from advertising and film. Mechanical revenue grew 27.8% year-over-year, or 21.1% in constant currency, driven by the recent rebound in industry-wide physical sales, as well as the change in accounting.

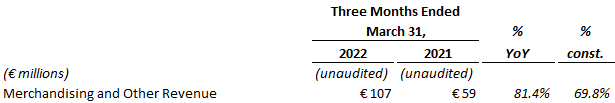

Merchandising and Other

Note: % YoY indicates % change year-over-year; % const. indicates % change year-over-year adjusted for constant currency.

Q1 2022

Merchandising and Other revenue grew to €107 million, up 81.4% year-over-year, or 69.8% in constant currency, as touring-related merchandising revenue rebounded following a COVID related slow-down in live touring.

Conference Call Details

The Company will host a conference call to discuss these results on Tuesday, May 3, 2022 at 6:15PM CEST. A link to the live audio webcast will be available on investors.universalmusic.com and a link to the replay will be available after the call.

While listeners may use the webcast, a dial-in telephone number is required for investors and analysts to ask questions. Investors and analysts interested in asking questions can pre-register for a dial-in line at investors.universalmusic.com under the “Financial Reports” tab.

Cautionary Notice

This press release is published by Universal Music Group N.V. and contains inside information within the meaning of article 7 (1) of Regulation (EU) No 596/2014 (Market Abuse Regulation).

Forward-looking statements

This press release may contain statements that constitute forward-looking statements with respect to UMG’s financial condition, results of operations, business, strategy and plans. Such forward-looking statements may be identified by the use of words such as ‘profit forecast’, ‘expect’, ‘estimate’, ‘project’, ‘anticipate’, ‘should’, ‘intend’, ‘plan’, ‘probability’, ‘risk’, ‘target’, ‘goal’, ‘objective’, ‘will’, ‘endeavour’, ‘optimistic’, ‘prospects’ and similar expressions or variations on such expressions. Although UMG believes that such forward-looking statements are based on reasonable assumptions, they are not guarantees of future performance. Actual results may differ materially from such forward-looking statements as a result of a number of risks and uncertainties, many of which are related to factors that are outside UMG’s control, including, but not limited to, UMG’s inability to compete successfully and to identify, attract, sign and retain successful recording artists and songwriters, failure of streaming and subscription adoption or revenue to grow or to grow less rapidly than anticipated, UMG’s reliance on digital service providers, UMG’s inability to execute its business strategy, the global nature of UMG’s operations, UMG’s inability to protect its intellectual property and against piracy, UMG’s inability to attract and retain key personnel, changes in laws and regulations and the other risks that have been described in UMG’s 2021 annual report. Accordingly, UMG cautions readers against placing undue reliance on such forward-looking statements. Such forward-looking statements are made as of the date of this press release. UMG disclaims any intention or obligation to provide, update or revise any such forward-looking statements, whether as a result of new information, future events or otherwise.

Alternative Performance Indicators

This press release includes certain alternative performance indicators which are not defined in IFRS issued by the International Accounting Standards Board as endorsed by the EU. The descriptions of these alternative performance indicators and reconciliations of non-IFRS to IFRS measures are included in the Appendix to this press release.

About Universal Music Group

At Universal Music Group (EURONEXT: UMG), we exist to shape culture through the power of artistry. UMG is the world leader in music-based entertainment, with a broad array of businesses engaged in recorded music, music publishing, merchandising and audiovisual content. Featuring the most comprehensive catalogue of recordings and songs across every musical genre, UMG identifies and develops artists and produces and distributes the most critically acclaimed and commercially successful music in the world. Committed to artistry, innovation and entrepreneurship, UMG fosters the development of services, platforms and business models in order to broaden artistic and commercial opportunities for our artists and create new experiences for fans. For more information on Universal Music Group N.V. visit www.universalmusic.com

Contacts

Media

James Murtagh-Hopkins – communicationsnl@umusic.com

Investors

Erika Begun – investorrelations@umusic.com

Upcoming Calendar

Annual General Meeting of Shareholders: May 12, 2022

1H 2022 Results: July 27, 2022

Appendix

Reconciliation of Adjusted EBITDA

DEFINITIONS

In this press release, UMG presents certain financial measures when discussing UMG’s performance that are not measures of financial performance or liquidity under IFRS (“non-IFRS”). These non-IFRS measures (also known as alternative performance measures) are presented because management considers them important supplemental measures of UMG’s performance and believes that they are widely used in the industry in which UMG operates as a means of evaluating a company’s operating performance and liquidity. UMG believes that an understanding of its sales performance, profitability, financial strength and funding requirements is enhanced by reporting the following non-IFRS measures. All non-IFRS measures should be considered in addition to, and not as a substitute for, other IFRS measures of operating and financial performance as described in this press release. In addition, it should be noted that other companies may have definitions and calculations for these non-IFRS measures that differ from those used by UMG, thereby affecting comparability.

EBITDA and EBITDA margin

UMG considers EBITDA and EBITDA margin, non-IFRS measures, to be relevant measures to assess the performance of its operating segments as reported in the segment data. It enables UMG to compare the operating performance of operating segments regardless of whether their performance is driven by the operating segment’s organic growth or by acquisitions. EBITDA margin is EBITDA divided by revenue. To calculate EBITDA, the accounting impact of the following items is excluded from the income from Operating Profit:

- amortization of intangible assets;

- impairment losses on goodwill and other intangibles;

- other income and expenses related to transactions with shareowners (except when directly recognized in equity);

- depreciation of tangible assets including right of use assets;

- (gains)/losses on the sale of tangible assets, including right of use assets and intangible assets;

- (income)/losses from equity affiliates;

- restructuring expenses; and

- other non-recurring items.

Adjusted EBITDA and Adjusted EBITDA margin

The difference between EBITDA and Adjusted EBITDA consists of non-cash share-based compensation expenses [and certain one-time items that are deemed by management to be significant and incidental to normal business activity, including but not limited to professional fees and listing fees related to UMG’s listing on Euronext Amsterdam. Adjusted EBITDA margin is Adjusted EBITDA divided by revenue. UMG considers Adjusted EBITDA and Adjusted EBITDA margin, non-IFRS measures, to be relevant measures to assess performance of its operating activities excluding items that may be incidental to normal business activity.

[1]This press release includes certain alternative performance indicators which are not defined in the International Financial Reporting Standards (“IFRS”) issued by the International Accounting Standards Board as endorsed by the EU. The descriptions of these alternative performance indicators and reconciliations of non-IFRS to IFRS measures are included in the Appendix to this press release.